Company description

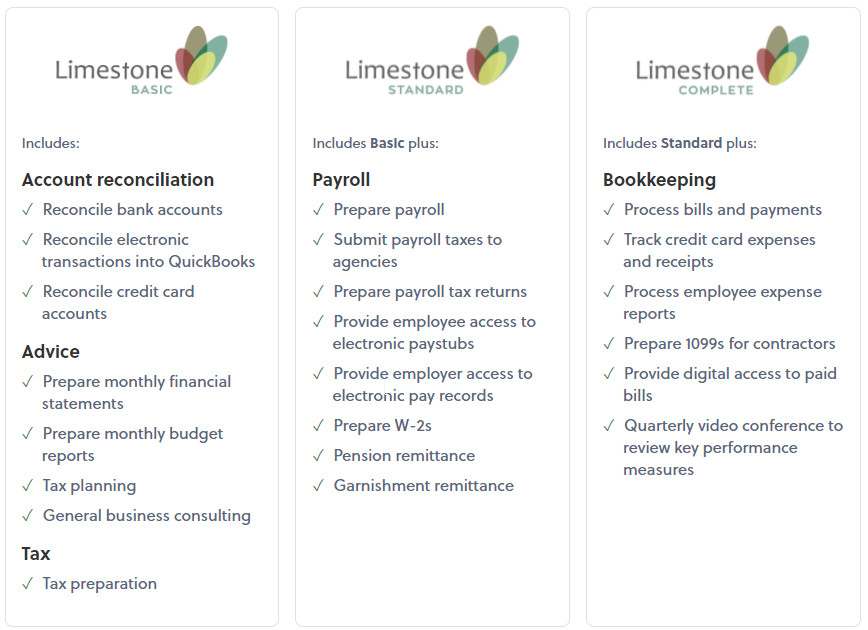

When you need a Yankton, SD bookkeeper, call Limestone Inc. We provide a variety of financial services for service-based organizations and professional services providers like law firms, as well as nonprofits, small businesses and more. Choose any of our packages for account reconciliation, payroll services, payroll processing service, bookkeeping, business tax support, organization foundation services, retirement plan analysis, QuickBooks help and more. We also have offices in Sioux Falls, SD and Brookings, South Dakota. Limestone Inc 416 Broadway Ave, Suite 2 Yankton, SD 57078 (605) 360-3790 https://www.limestonesd.com/ https://www.google.com/maps?cid=9911789747913185538 Trust that your accounting system will be efficient and well-maintained with Limestone Inc. We work to give you accurate, real-time information so you're never uninformed of your financial situation. Limestone Inc also helps you with retirement plan analysis. Having an exit strategy is always good. We'll find the plan that works best for you and your staff and your budget. Limestone Inc in Yankton delivers business management services designed to provide you the details you need in layman's terms. Our bookkeeping team will meet with you regularly to keep you up to date on all business insight data and we'll include personalized reports that include budgeting and tax planning. We offer payroll analysis, cost analysis, budgeting, income analysis, COGS (Cost of Goods Sold) analysis, capital analysis, market KPI (Key Performance Indicator) analysis and tax planning and forecasts. Contracting out work is among the very best ways any company owner can do to efficiently complete a bookkeeping project. One benefit is the time it frees up for you so you can concentrate on what's crucial - building and growing your business. Limestone Inc handles your day-to-day accounting jobs with our secure online platform developed specifically to ensure a structured and reliable workflow; this includes utilizing QuickBooks accounting software. Limestone Inc in Yankton offers three bookkeeping packages to choose from: 1. Limestone Basic 2. Limestone Standard 3. Limestone Complete Starting with Limestone Basic, this entry-level bookkeeping package features account reconciliation options such as the reconciliation of your bank accounts, entering electronic transactions into QuickBooks, and reconciliation of your credit card accounts. Limestone Basic also consists of guidance in the form of prepared monthly financial statements, the preparation of month-to-month budget reports, tax preparation and general business consulting. Limestone Basic also features annual tax preparation services. Limestone Standard is the second tier plan. The Standard package consists of additional bookkeeping services, including account reconciliation, tax guidance services, along with payroll preparation and submission, tax returns, paycheck garnish remittance, pension remittance, electronic pay stubs and W-2 preparation. The Limestone Complete strategy is the top tier full-service bookkeeping bundle and it also includes account reconciliation, payroll, tax recommendations services. It additionally includes accounting solutions, such as the processing of payments and invoices, credit card reconciliation and receipt tracking, employee expense report processing, contractor 1099 preparation, digital access to paid invoices and quarterly video conferences to review essential performance actions. Trust Limestone Inc in Yankton if you're looking for a tax professional to handle your personal income taxes. We also provide customized support to get you the largest return possible while helping you find every available deduction. At Limestone Inc, you can come to us for tax support all year round, so when significant changes happen, we can help you navigate the new tax implications. You learn a lot of things through trial and error when you're a new business owner. When it comes to money management, it's best to get it right from the beginning. Limestone Inc in Sioux Falls can help you create a strong financial foundation by providing budgetary recommendations in start-up areas such as entity type analysis, accounting system setup and retirement plan analysis. We help identify the best plans for your employees and for you, as well as deal with state and federal form preparation so you don't miss out on opportunities to save money.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-